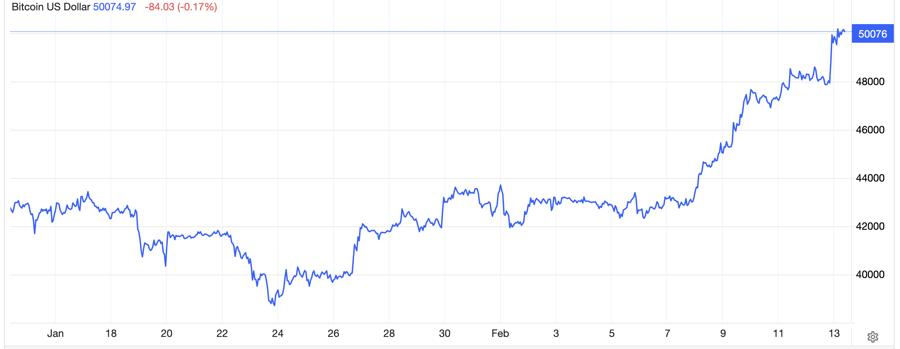

Bitcoin price broke through the $50,000 mark during the trading session on Monday (February 12), at one point reaching its highest level in more than 2 years. The trend of attracting net capital from spot bitcoin exchange-traded funds (ETFs) is one of the driving forces for the price of the world’s largest virtual currency to explode.

According to data from Coinmarketcap.com, the bitcoin price at 9am this morning (February 13) Vietnam time stood at 50,134 USD, up 3.3% compared to 24 hours ago and up nearly 18% in the past year. within 1 week. In the first session of the week, bitcoin price sometimes reached 50,334 USD, the highest since December 2021.

The price of the world’s second largest virtual currency, ether, also increased sharply, reaching 2,679 USD at 9:00 a.m. this morning, up 6.4% compared to 24 hours earlier and up more than 16% within a week.

“$50,000 is a major milestone for bitcoin, after the launch of spot bitcoin ETFs last month failed to get bitcoin prices past the mark and led to a sell-off and skepticism. about new investment products,” Mr. Antoni Trenchev – co-founder of virtual currency service company Nexo – commented to CNBC news agency.

Optimism has returned to the virtual currency market, after a large withdrawal of investors from the Grayscale Bitcoin ETF made investors pessimistic in the past month. Not only has withdrawal activity subsided recently, but inflows into spot bitcoin ETFs are increasing.

In addition, bitcoin price also benefits from an increase in risk appetite in the context of the US stock market maintaining an uptrend. After the S&P 500 index surpassed the 5,000 point mark for the first time in history last week, both the S&P 500 and the Dow Jones index set new records during Monday’s trading session.

“There are a number of factors influencing market dynamics, including China’s pursuit of an easy monetary policy. That leads to increased demand for holding assets, including bitcoin,” chief researcher James Butterfill of virtual currency management company CoinShares told CNBC.

“Investor demand for spot bitcoin ETFs remains strong, with net inflows of $1.1 billion over the past week and $2.8 billion since the funds This was born. On Friday alone, ETFs bought 12,000 bitcoins, far exceeding the daily bitcoin mining output of about 900,” Mr. Butterfill added.

Capital investors consider the threshold of 48,600 USD/oz as a key resistance level for bitcoin. If this mark is maintained, bitcoin price could break further from the $50,000 mark and could even set a new all-time record – according to technical analysts.

Bitcoin’s price record was set on November 10, 2021, at nearly 69,000 USD. This year, bitcoin prices have increased by more than 16%.

The US Securities and Exchange Commission (SEC) approved the establishment of the first spot bitcoin ETFs in the country on January 10 – a move considered a turning point for bitcoin in particular and the industry in particular. virtual currency in general after 10 years of efforts to obtain this investment product.

Bernstein analysts predict spot bitcoin ETFs will attract more than $10 billion in capital this year. Standard Chartered Bank forecasts a net capital flow of 50-100 billion USD into these funds in 2024 alone. Other forecasting organizations put the figure at 55 billion USD in 5 years.

In addition to the appeal of spot bitcoin ETFs, another driving force for bitcoin’s price increase comes from the halving event scheduled to take place in April. This is an event that takes place every 4 years to reduce halve the reward for bitcoin miners, thereby limiting the supply of this virtual currency to a maximum of 21 million VND. To date, 19 million bitcoins have been mined. Bitcoin price has increased in all three previous forks, with the most recent occurring in 2020.