The selling force that appeared at the end of the session caused the VN-Index to decrease slightly by nearly 0.5 points. The board was electrified when the cash flow was only concentrated in a few codes, scattered across industries.

VN-Index opened in the green, increasing more than 5 points after just the first 20 minutes of trading. After that, the index representing the HoSE floor lowered its height and began to shake at the end of the morning session. This index stayed close to the reference until nearly 14:00, before recording stronger selling pressure and being dyed red. In the last minutes of the session, the index continuously struggled.

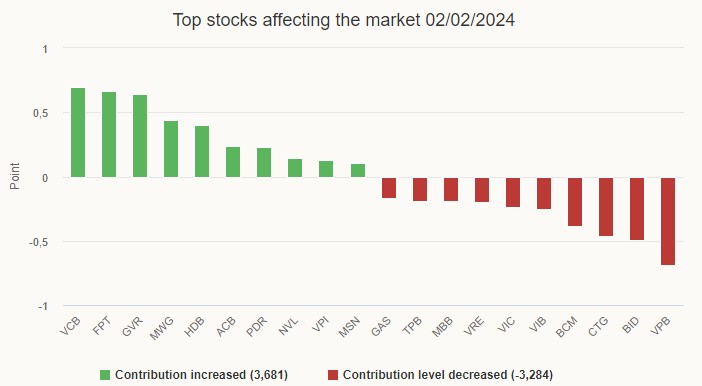

VN-Index closed at 1,172.55 points, down slightly by nearly 0.5 points compared to yesterday. The entire HoSE floor had 267 codes decreasing, while 199 codes increased.

The three groups technology, retail and chemicals continue to lead the industry index. The positive developments of the groups mainly came from the traction of pillar stocks such as FPT, GVR and MWG. All three of these codes increased by over 2% today and ranked 2nd, 3rd and 4th respectively in the top 10 stocks contributing the most to the VN-Index.

Real estate industry index decreased, but some stocks still appeared to lead the market. NVL ranks first in liquidity with more than 1,130 billion VND, accounting for nearly 6% of the total trading value on HoSE. Novaland’s stock code closed the session up 1.8%. PDR ranks second in terms of liquidity with nearly 970 billion VND. The market price of this stock accumulates 4.4% more than the reference. Both are in the top 10 stocks contributing the most increase to the market.

Today, the electricity board of the securities industry also appeared many shades of green. Typically, MBS closed the session 2.7% higher than the reference. Two codes VIX and VCI both increased over 1%. SSI only moved up 0.4% in market price, but its liquidity was among the highest in the market with more than 820 billion VND.

Liquidity continued to go in the opposite direction of the score. The total transaction value on HoSE reached more than 20,000 billion VND, an increase of more than 4,700 billion VND.

After three sessions of prioritizing goods consolidation, foreign investors today returned to net selling more than 210 billion VND. They focus on selling the codes VNM, SHS, PC1.

Siddhartha